How do the Various Retirement Accounts Compare? (401k vs IRA vs HSA)

What is the difference between all these retirement accounts?

One sentence helped me understand all of this.

The purpose of every retirement account is to save money on taxes.

The reason why any retirement account exists is to pay fewer taxes on the money we earn.

We call these tax-advantaged accounts.

In each of these accounts, you can invest however you want. Mutual funds, ETFs, stocks, you name it. The only difference is when you’re taxed.

Over a long period of time (e.g. the 20-40 years you may have until retirement), any amount of tax will add up and eat away at your retirement savings. That is why tax-advantaged accounts are quite popular for long-term savings.

The Three Tax Benefits

There are three tax benefits that we can use to compare these three retirement accounts:

1. Tax-Free Contributions

If an account offers tax-free contributions, then your money goes straight to your retirement account before it is taxed (pre-tax). You’ll never see it in your checking account.

If you were to transfer money from your checking account into your retirement account, then that is a post-tax contribution since any income you’ve earned has been taxed.

In order words, you get a tax deduction and lower your taxable income when you put money into an account with pre-tax contributions.

2. Tax-Free Growth

If your investments grow tax-free in a retirement account, then you won’t pay any taxes on any earned money.

You could buy any stock. Let’s say the stock doubles. You’re good to go. No tax.

Taxable accounts (e.g. traditional savings accounts, brokerage accounts, CDs, money markets, etc.) require you to pay a capital gains tax the year your investments gain value.

3. Tax-Free Withdrawals

An account with tax-free withdrawals does not require taxes to be paid on any money you take out of it, given that you follow their withdrawal rules.

Overview

The three retirement plans follow this table below.

| Tax-Free Contributions | Tax-Free Growth | Tax-Free Withdrawals | |

|---|---|---|---|

| 401k | ✓ | ✓ | |

| Roth IRA | ✓ | ✓ | |

| HSA | ✓ | ✓ | ✓ |

1. Traditional 401k Plan

| Tax-Free Contributions | Tax-Free Growth | Tax-Free Withdrawals | |

|---|---|---|---|

| 401k | ✓ | ✓ |

The traditional 401k plan is a very popular employer-sponsored savings plan, which simply means that it’s only available if your employer offers it for you.

Many employers offer 401k matching, meaning they will double the pre-trax money that you contribute (with limits, of course). They may offer a dollar-for-dollar matching or 50% matching up to a certain percentage of your salary.

For example, a dollar-for-dollar matching up to 5% of a $100k salary means that if you contribute $5k to your 401k, you will actually have $10k in your 401k. If you contribute $1k, you will have $2k. If you contribute $8k (over 5% of $100k), you will have $13k.

As of 2022, the 401k contribution limit is $20,500 for workers under the age of 50. Those 50 and above can contribute an extra $6,500.

While this is employer-sponsored, anything you contribute stays with you even if you were to leave that employer. That being said, be sure to read up on the employer benefits. Some employers will not offer the match until you’ve worked with them for a number of years.

At 59 1/2 years old, you have the option of withdrawing funds that will be taxed at the income rate for that year. If you were to withdraw anytime earlier, you will pay a 10% withdrawal penalty along with income tax on the distribution. That would be very sad. So don’t do it, please.

At 70 1/2 years old, you are required to take distributions.

Plans Similar to the 401k

- Traditional IRA: Think 401k without your boss.

- 403b Plan: Think 401k for tax-exempt organizations and non-profits: teachers, professors, government employees, doctors, etc.

- 457 Plan: Think modified 401k for state and local government employees as well as non-profits.

2. Roth IRA (Individual Retirement Account)

| Tax-Free Contributions | Tax-Free Growth | Tax-Free Withdrawals | |

|---|---|---|---|

| Roth IRA | ✓ | ✓ |

The term “Roth” refers to post-tax contributions. Well, it refers to a guy named William V. Roth. I guess he’s not just any guy. He was a Senator. But that’s beside the point.

You don’t get the tax benefit during that year you contribute, but your distributions become tax-free.

Similar to the 401k, you will owe a 10% penalty and income tax on early withdrawals (before 59 1/2 years old).

One thing that many people don’t know about Roth IRAs is that you can always withdraw money that you contribute without penalty. You just can’t take from the earnings.

You can also be exempt from taxes and penalties if you’ve had the Roth IRA for more than five years and meet the criteria for certain exceptions that are known as qualified distributions.

As of 2022, the Roth IRA contribution limit is $6,000 per year, but different rules apply given your filing status and income.

Plans Similar to the Roth IRA

- Roth 401k: Think 401k but post-tax

- Roth 403b: Think 403b but post-tax

- Roth 457: Think 457 but post-tax

3. HSA (Health Savings Account)

| Tax-Free Contributions | Tax-Free Growth | Tax-Free Withdrawals | |

|---|---|---|---|

| HSA | ✓ | ✓ | ✓ |

The three checkmarks above seem too good to be true, but it’ll make sense soon enough.

Brief Explanation

When most people think of HSAs, they think of a savings account to pay for healthcare expenses with tax-free money.

They are completely correct. HSAs are savings accounts that can only be used for qualified healthcare expenses. Any other expenses before the age of 65 will lead to a 20% penalty and owed income tax.

At the age of 65, your HSA begins to function as a traditional IRA, allowing you to use the HSA funds on non-medical expenses.

As of 2022, the HSA contribution limits for individual coverage and family coverage is $3,650 and $7,300, respectively.

In order to be eligible for an HSA, you need to be enrolled in a high-deductible health plan (HDHP), which is just a plan with a higher deductible than a traditional insurance plan.

Deductibles refer to the amount you pay your health care before your insurance company begins to pay. A higher deductible means you pay for more of your initial health care costs, but you also pay lower monthly premiums. This amount depends on your insurance plan and what your insurance covers.

This is especially beneficial in two scenarios:

- If you’re super healthy, you won’t pay the deductible and will have lower premiums.

- If you’re super sick, you’ll always go through the deductible and your insurance will pick up

100%of the cost after that.

Some insurance companies also offer a premium pass-through contribution, which is very similar to 401k employer matching, where insurance companies deposit a portion of your premiums into your HSA account each year. Essentially, you will be receiving free money from your insurance company each year.

How does this work for retirement?

Everybody will have medical expenses. That is a natural part of life. Not chosen. It just happens.

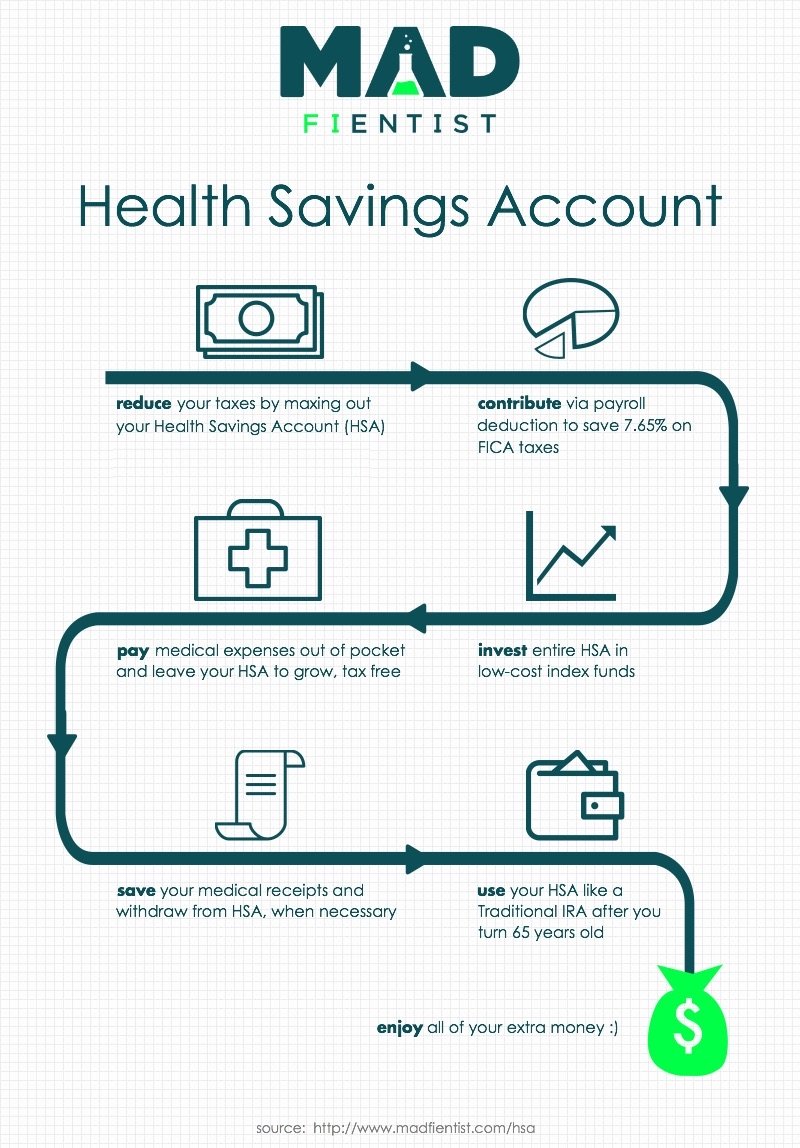

The idea is that you keep maxing out your HSA every year. Whenever a medical expense comes up, you pay out-of-pocket and leave your HSA to grow tax-free.

The great thing is that you can pay yourself back for this medical expense whenever you want. You don’t want to mess with the power of compound interest your HSA has.

If you keep your medical receipts, you can withdraw money from your HSA years and years into the future for these qualified medical expenses. And the best part? This is all after the money has grown already. You’re paying back the initial amount but keeping the interest.

This is a great graphic made by Mad Fientist: